Interest-Bearing Dollar

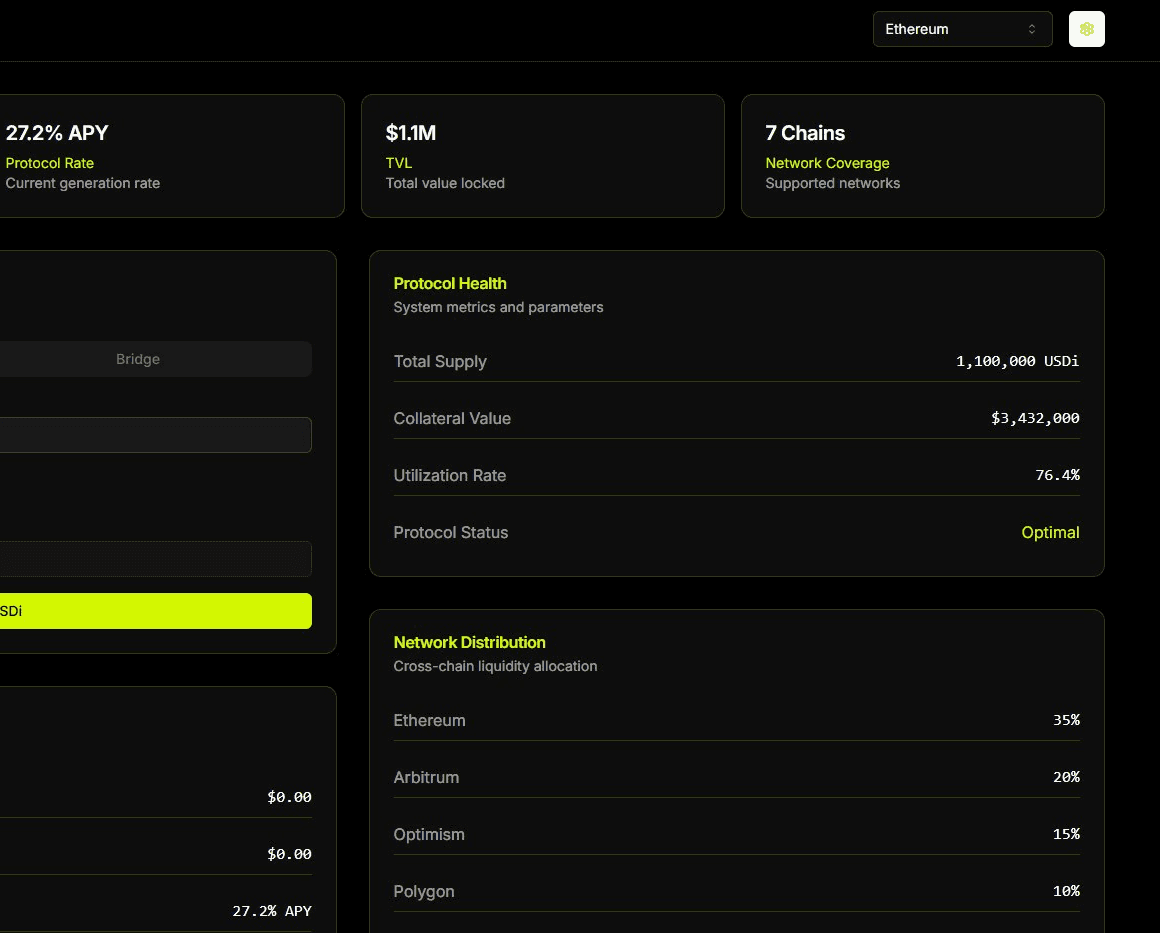

USDi implements automated yield generation while maintaining strict dollar parity through overcollateralization.

Protocol Architecture

Overcollateralization

312% collateral ratio maintained through automated position management and liquidation mechanisms.

Cross-Chain Implementation

Native implementation across 7 blockchain networks with atomic bridge functionality.

Yield Generation

Automated deployment across diversified lending protocols generating 27.2% APY.

Protocol Implementation

Payment Infrastructure

- Cross-chain settlement layer

- Atomic swap functionality

- Zero slippage conversion

- Instant finality across networks

Staking Mechanism

- Validator collateral

- Liquid staking integration

- Protocol governance

- Yield distribution system

Collateral Utility

- Lending protocol integration

- 312% collateralization ratio

- Liquidation protection

- Cross-margin functionality

Technical Architecture

Asset Conversion

Conversion of supported stablecoins to USDi through smart contract interaction

Cross-Chain Bridge

Atomic transfers across 7 supported blockchain networks

Yield Distribution

Automated deployment to lending protocols at 27.2% APY

Liquidity Management

Dynamic liquidity allocation across supported networks

interface IUSDi is IERC4626 {

// Liquidity management

function deposit(

address liquidityToken,

uint256 amount

) external returns (bool);

function withdraw(

address liquidityToken,

uint256 amount

) external returns (bool);

// Lending and borrowing

function issueLoan(

address recipient,

uint256 amount,

uint256 rate,

uint256 term,

bytes calldata data

) external returns (uint256 loanId);

function repayLoan(uint256 loanId, uint256 amount) external returns (bool);

// Yield distribution

function distributeYield() external returns (bool);

// View functions

function getCollateralRatio(

address account

) external view returns (uint256);

function getAccountLiquidity(

address account

) external view returns (uint256);

function getUtilizationRate() external view returns (uint256);

function getCrossChainProtocolLiquidity() external view returns (uint256);

// Events

event LiquidityDeposited(

address indexed account,

address indexed liquidityToken,

uint256 amount

);

event LiquidityWithdrawn(

address indexed account,

address indexed liquidityToken,

uint256 amount

);

event LoanIssued(

uint256 indexed loanId,

address indexed recipient,

uint256 amount,

uint256 rate,

uint256 term,

bytes data

);

event LoanRepaid(

uint256 indexed loanId,

address indexed account,

uint256 amount

);

event YieldDistributed(uint256 amount);

}

Technical Specifications

Payment Protocol

Implementation of cross-chain message passing for atomic settlements with instant finality.

Staking Integration

Native staking contract implementation with automated reward distribution and governance mechanisms.

Collateral Management

Smart contract system maintaining 312% collateralization through automated position management.

Yield Distribution

Automated deployment across lending protocols generating 27.2% APY with dynamic rebalancing.

Protocol Documentation

Technical specifications and implementation details